The Canadian mining giant confirmed, in its latest quarterly activity report, the rise of its African assets, which now represent a third of its global gold production and more than half of its copper volumes.

De News

Botswana announces the discovery of the 3rd largest diamond in the world

Debswana announced on Wednesday June 16 the discovery of a 1,098-carat stone, which would make it the third largest known diamond in the world.

Côte d’Ivoire: the energy crisis threatens the cocoa industry

Barely recovered from the negative effects of the economic crisis and the restrictions imposed by the multinationals, the cocoa industry is once again facing an umpteenth challenge, power outages.

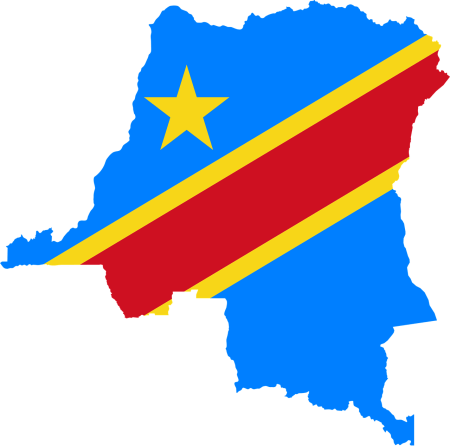

The DRC wants to review its mining contracts

Visiting the town of Kolwezi, the mining eldorado of Katanga, on May 13, the President of the Democratic Republic of Congo (DRC), Felix Tshisekedi, strongly criticized mining operators.

Gold: Canadian Fortuna enters West Africa with the acquisition of its compatriot Roxgold

In West Africa, consolidation in the gold sector continues. After the successive takeovers of the junior Semafo and Teranga Gold by the British Endeavour Mining, it is now the turn of the Fortuna Silver Mines group to acquire its Canadian compatriot Roxgold, which is present in the sub-region.

Fertilizer: West African agricultural sector worried as input prices soar

The main source of activity in the subregion (60% of jobs) and at the heart of food security and national sovereignty issues the West African agricultural sector has been hit hard by the soaring prices of the main fertilizers.

Renaissance Dam: the dialogue of the last chance?

In the battle over the Nile between Egypt, Sudan and Ethiopia, this may be the last chance for diplomacy and conciliation. The Congolese presidency announced on March 30 that Felix Tshisekedi will soon host a round of negotiations between Cairo, Khartoum and Addis Ababa over the Ethiopian Renaissance Dam.

Banana: Côte d’Ivoire confirms its status as African leader

The Ivorian banana industry remains on a positive note despite the crisis, retaining its position as the leading African producer.

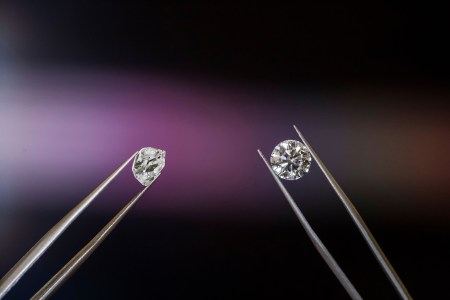

Diamond dealer De Beers is smiling again

Hit hard by the Covid pandemic in 2020, South Africa’s De Beers confirms a solid recovery in its business.

Côte d’Ivoire: a cocoa industry at a crossroads

Engaged in a battle to impose more favorable compensation on local cocoa producers, Ivorian authorities must learn from their past failures, believes our columnist Micée Dare.

Agriculture: South Africa posts record exports

Despite a sluggish global economy linked to the coronavirus pandemic, South Africa’s agricultural exports reached a record level in 2020.

Gold should remain strong in 2021, according to the World Gold Council

Marked by uncertainty due to the Covid-19 pandemic, the year 2021 should confirm the yellow metal’s status as a safe haven, according to the World Gold Council (WGC).

TCX, the fund that shields emerging countries against currency risk

Badly hit by the economic crisis caused by the Covid-19 pandemic, several African countries have seen their currencies depreciate over the past year. This unfavorable situation is a reminder, if need be, that the continent’s currencies are often vulnerable to external shocks. However, there are solutions, such as the exchange rate hedges offered by the Dutch development fund TCX, a financial vehicle designed to combat currency volatility in emerging countries. For Ressources, Isabelle Lessedjina, Senior Vice President at TCX, explains the concept of the fund as well as its ambitions for Africa.

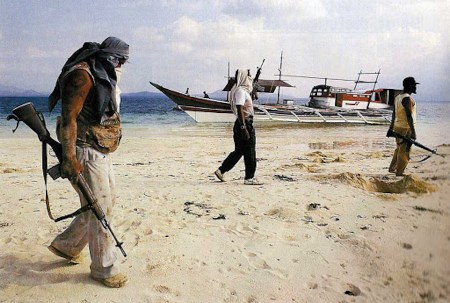

Joanne Lebert, Executive Director of Impact: « Mining smuggling is more omnipresent than ever in the DRC ». »

Driven by a high price, African gold has never been in greater demand. A favorable situation that nevertheless contributes to reinforcing the illicit trade, denounces the Canadian NGO Impact, active on issues related to the governance of natural resources.

Growth: the 5 sub-Saharan African countries that will suffer the most in 2020

While the IMF estimates a 3 percent drop in the region’s GDP in 2020, not all countries will be equally affected. Commodity exporting countries are among those most affected. A review of the 5 African economies that will lose the most this year.

What Africa can learn from Asia

Once again, in the wake of the coronavirus crisis, African commodity-producing nations are being hit hard by the (declining) volatility of global prices. However, there is no inevitability, as the example of East Asian nations proves.

Peanut: IFTC confirms its support to the Senegalese oil company Sonacos

A traditional partner of the Senegalese peanut industry, ITFC, a subsidiary of the Islamic Development Bank specialized in trade finance, approved on November 17 the awarding of a new grant to Sonacos (Senegal’s national oilseed marketing company).

Rwandan green fund gets new management

Launched in 2012 to support the Rwandan authorities’ ambition to make the country of the Thousand Hills a low-carbon and climate-resilient economy by 2050, the Rwanda Green Fund will change its mind. Following the last meeting of the presidential cabinet, held on Wednesday, July 15, Teddy Mugabo was appointed chief executive officer of the institution, better known as FONERWA in Rwanda. Until now head of business development of FONERWA, the new leader will have the task of continuing the efforts made by the previous management to succeed in the challenge of climate transition. This includes providing financial resources for all kinds of initiatives considered « eco-friendly »: community rooftop rainwater harvesting systems, waste management, affordable zero-carbon housing, a 500-kW hydroelectric power plant along the Gaseke River, etc.

Uganda’s oil and gas sector: Uganda puts its money where its mouth is to strengthen its local training programmes

Anticipating the growing need for skilled local labour that will arise with the upcoming start of oil exploitation in the country - expected in 2023 - the Ugandan government has released 5.4 million dollars, intended to strengthen training related to the hydrocarbon sectors (oil & gas). Out of this package, 8 billion shillings (US$2.4 million) will be used to launch the Kichwamba Technical College, a public institution of higher learning, which will offer training in welding, metal fabrication, electrical installation and plumbing, among others. The new public educational institution will join the Uganda Petroleum Institute in Kigumba, which has so far been the only state institution producing world-class certified technicians. The authorities have also called on the private sector to join the government’s efforts to rapidly offer further training in these fields.

Kenya: Tea sector exports less

The latest edition of the World Bank’s Commodity Markets Outlook predicted it: in the wake of the coronavirus health crisis, tea selling prices have plummeted everywhere due to weak global demand. The latest figures from Kenya, the world’s largest exporter of black tea, confirm this. According to data released on 10 July by the Tea Directorate, Kenya’s regulator of the industry, revenue from domestic tea exports fell by 1.3 billion shillings (US$13 million) in the first five months of the year, as the negative impact of the coronavirus crisis resulted in a drop in the average price per kilogram compared to the same period last year (from 238 shillings to 223 shillings). As for the volumes sold, between January and May, the country sold six million kilos less than during the same period in 2019, the Kenyan public agency said.

Somalia: When illegal fishing threatens national and regional economy

The stakes: to understand, through data assessed for the first time, how the phenomenon of illegal fishing destabilizes the country and the sub-region, and the need to put in place strong enough maritime regulations to counter this phenomenon.e en place une réglementation maritime suffisamment forte pour pallier ce phénomène Estimated at USD 300 million according…

Zambia: the copper industry is on the rise, despite the coronavirus health crisis

The second largest copper producer on the African continent, Zambia continues to perform well despite the coronvairus health crisis. On Thursday 9 July, the Ministry of Mines announced that the country’s copper production reached 342,734 tonnes in the first five months of this year, an increase of 3.85% compared to the same period in 2019 (330,024 tonnes). Better still, according to the Zambian authorities, copper production is expected to continue to grow in the third and fourth quarters, due to higher prices linked to factors such as the growing production of electric vehicles, which depend on copper. This optimistic projection, if realised, will further reinforce the strategic importance of copper in the Zambian economy: revenues from ore mining account for 70% of the country’s export earnings.

Mining: Sundance Resources issues ultimatum to Chinese partner AustSino

The stakes: For Australian Sundance Resources, to finally start operating the Mbalam-Nabeba project. Historic operator of the Mbalam-Nabeba mining project, Australian Sundance is giving its Chinese partner AustSino one last chance to reach a final agreement. For Australian Sundance Resources, which has been piloting the Mbalam-Nabeba iron ore mining project on the Cameroon-Congo Brazzaville border…

Despite a difficult economic climate, Benin maintains its cotton prices

Stake : For Benin, to support the cotton sector, a key sector of the national economy, at all costs. In contrast to other producing nations in the sub-region, Benin has decided to keep the price per kilo of cotton unchanged for the 2020/2021 campaign. The country thus confirms its strong support for the country’s very…

Cocoa: Covid-19 exposes the fragility of mechanisms to combat child labour

Stake: to identify the impact of Covid-19 on the well-being of the farmers and particularly their children, as well as the solutions to be provided to prevent the worsening of an already precarious situation. Between 17 March and 15 May 2020, the International Cocoa Initiative (ICI) Foundation analysed data from 263 cocoa-producing communities (1,443 households…