Coronavirus/raw materials: losers and winners

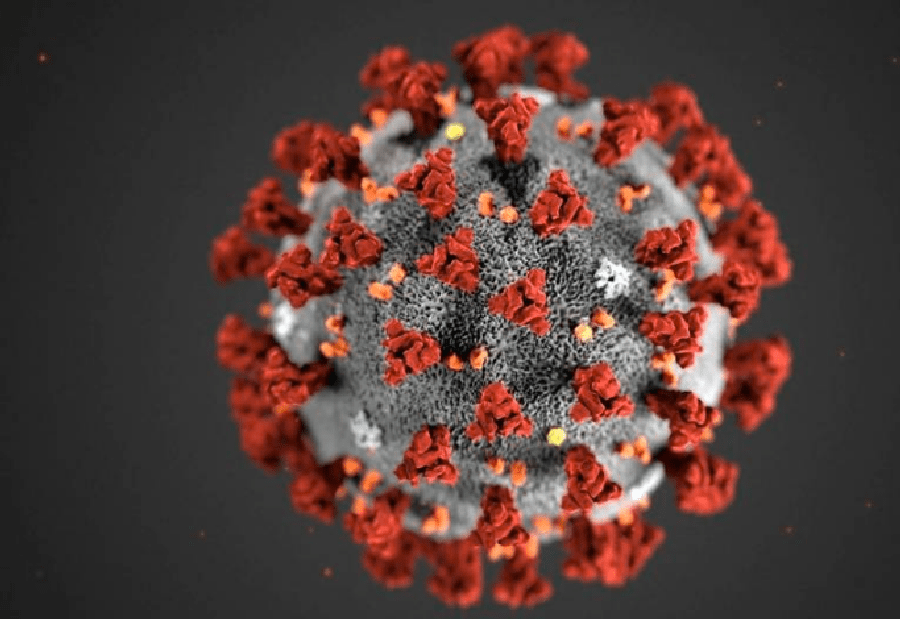

Having started in China in early December 2019, the pneumonic flu epidemic is now spreading to the rest of the world, impacting the entire global economy in its wake. The commodities market is no exception. A look at the sectors that are suffering from it… or benefiting from it.

Oil

While WHO Director-General Tedros Adhanom Ghebreyesus warned on Monday 24 February that the world was threatened with a « pandemic » due to the spread of the Covid-19 coronavirus (80,000 people infected worldwide and more than 2,700 deaths recorded), oil prices continued to plummet, with a barrel of Brent crude trading at less than 55 dollars in London. This level had not been reached since the end of 2018. This was due to a sharp drop in demand for black gold from China - the world’s largest importer. This fell from 11 million barrels/day before the start of the epidemic to just over 7 million in mid-February. This is very bad news for the African oil industry, which sells on average 42% of its production to the Middle Kingdom, according to the Africa Energy Outlook 2020 report of the African Energy Chamber, published at the end of November.

Read also: In the wake of the coronavirus, the IMF lowers its growth forecast for Nigeria

Main affected countries: Nigeria, Angola, Algeria, Gabon, Equatorial Guinea, Congo…

Metals: Copper, iron and zinc

Another big loser in the coronavirus economic crisis is copper. Since the first alarming announcements made in the Chinese city of Wuhan, the original focus of the epidemic, prices of the red metal have continued to contract. As a result, the price on the London Stock Exchange is now below $5,700 per tonne, down more than 13% year-on-year. This has given the Congolese and Zambian governments, whose revenues from this raw material account for up to 70 per cent of export earnings, a cold sweat. This fear is also shared by the continent’s major iron producers (Mauritania, South Africa, Algeria, etc.), at a time when the tonne of metal is down by nearly 30% (around $86) since its previous peak in July 2019, as it is very strongly correlated with the colossal needs of Chinese customers in normal times (60% of world iron imports). The same applies to zinc, which is mined in Morocco, Namibia and South Africa, where prices have also been at their lowest since July 2016.

Main affected countries: DRC, Zambia, South Africa, Morocco, Mauritania, etc.

Palm oil

In the agricultural sector, the year got off to a very bad start for palm oil, which was also affected by concerns about the spread of the coronavirus in China and the rest of the world, but also by the recent measures taken by India to reduce its imports. The price of this oil from palm kernels was trading at the end of February in Kuala Lumpur - the reference point for this raw material - at around 2,600 ringgits (US$616) per tonne, more than half of the peak reached in 2014, when prices approached 5,000 ringgits. Another time… Since then, the value of palm oil has fallen by nearly one-sixth in January alone, its biggest monthly decline in six years. A spectacular decline that certainly does not do business for the African producing countries, most of which are located along the Gulf of Guinea.

Main affected countries: Côte d’Ivoire, Sierra Leone, Gabon, Cameroon, DRC…

Or

As the world panics at the thought of a new pandemic and the prices of the main raw materials stumble, gold is once again playing its role as the ultimate safe haven. At close to $1,700 per ounce, the yellow metal is at its highest level in seven years, up 25% over 12 months! And the rise could continue, with David Govett, analyst for Marex Spectron, estimating that « the more the disease spreads and the more hysterical the headlines become, the higher the price will go ». A warning that should sound like a sweet melody to the ears of the main African gold-producing countries (Ghana, Sudan, Mali, Burkina Faso, South Africa). In fact, the continent’s major gold operators (Harmony Gold, AngloGold Ashanti…), who recently announced their financial results, are already rubbing their hands with it.

Main beneficiary countries: Ghana, Mali, Burkina Faso, South Africa, Sudan…

Read also: AngloGold Ashanti in Olympic shape

Read also: South Africa’s Harmony Gold returns to profits